India’s marketing economy is moving through a visible shift. Digital advertising has become the largest slice of the media pie, and the software behind marketing is taking a bigger share of budgets inside brands. The direction is clear. What remains contested is whether Indian marketers are extracting full value from the tools they buy, how that value differs by sector and company size, and what will separate leaders from everyone else over the next two years.

Digital media overtook television in India in FY24 with an estimated 41 percent share of total ad spend. That milestone capped years of change driven by cheaper data, broader smartphone use, and performance buying models that let brands reach consumers with fine control on cost. The shift continued in FY25. Multiple industry trackers place digital at roughly 45 to 46 percent of total ad expenditure and put the overall advertising market above one lakh crore rupees. The gap between digital and traditional is now wide enough that most media plans begin with mobile, search, social, and marketplace inventory before moving to television and print. For chief marketing officers, this is not only a media planning story. It is a signal that measurement, data, and automation have moved from support functions to the center of the growth agenda.

Inside this top line pivot sits a quieter question that determines whether the digital share gains translate into profit. How much of the total marketing budget is flowing into marketing technology, and how fast is that allocation rising. India does not yet have a single official benchmark that is updated every quarter, so the best view is a triangulation of respected studies and the procurement patterns that agencies and vendors report. One notable signal is the jump in the share of brands that allocate a meaningful slice of budgets to technology. A growing majority now report that more than one sixth of their marketing spend goes into platforms, analytics, data pipelines, and workflow tools. That is a sharp rise compared with the situation just a year earlier, and it matches what systems integrators see in briefs that pair media with data work, consent management, and journey orchestration.

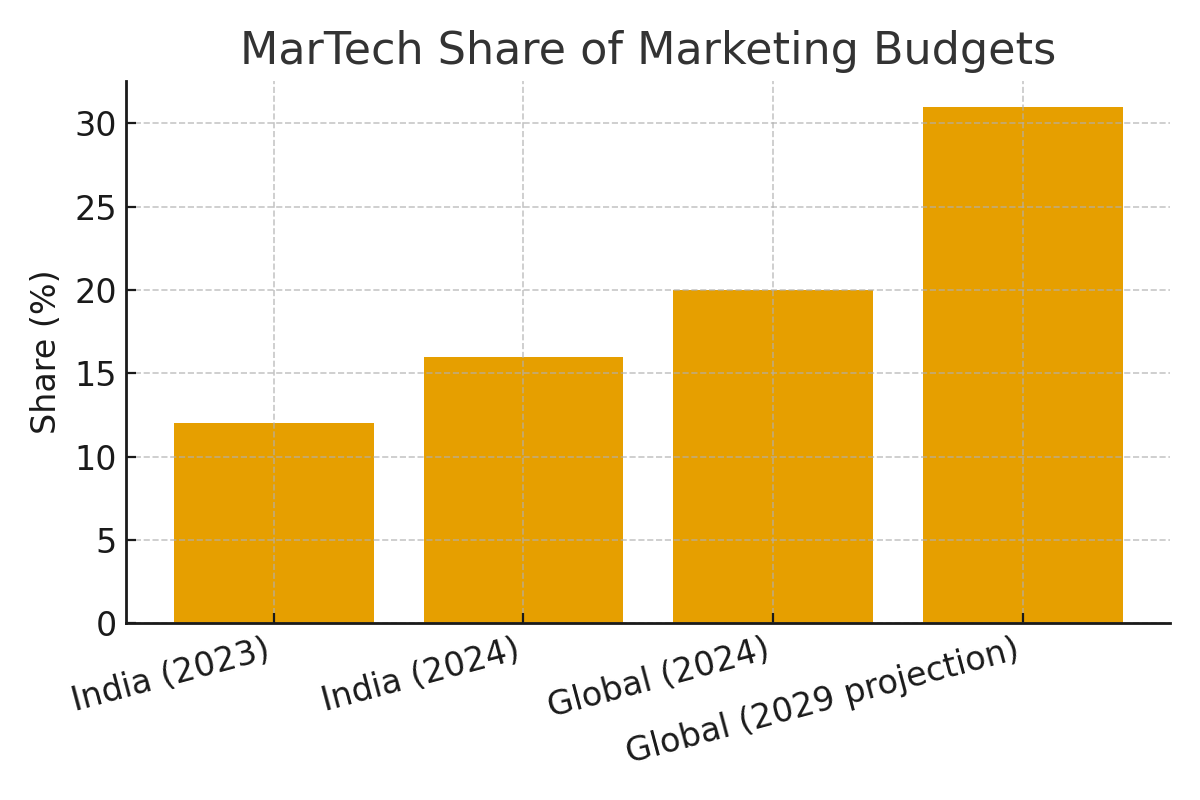

Global benchmarks help anchor expectations. The long running CMO Survey reports that companies spend about one fifth of their marketing budgets on technology today and plan to rise toward roughly one third within five years. The same dataset surfaces a hard operational reality that Indian teams will recognise. Only a little over half of purchased tools are in active use. The rest sit idle or are underused until teams align workflows, pipelines, and governance to turn licenses into outcomes. That underuse is not a sign that the tools are flawed. It is a sign that buying software is the easy part, and that capture of value depends on process change, cross functional ownership, and a clear map from tool to metric.

Budget context is the second anchor. Global surveys indicate that marketing budgets have held near 7.7 percent of company revenue across the last two years. When headline budgets are flat, technology buying serves two linked jobs. Leaders seek efficiency that frees up cash for media, and they seek capability that improves relevance and measurement. That is the same calculus Indian brands face, only with faster growth in digital channels and more variance across sectors.

If digital is claiming share and retail media is compounding, where is MarTech spend going inside Indian stacks. Public numbers remain thin, but three patterns show up repeatedly in procurement and deployment.

First, the data foundation has moved from nice to have to must have. Customer data platforms, consent and identity infrastructure, and analytics layers are now common asks in requests for proposal from larger consumer businesses. This aligns with global evidence that more than half of marketing activities already rely on software. Indian enterprises in e commerce, financial services, and telecom tend to lead because the business case is immediate. A stronger data spine lowers acquisition cost through cleaner audience construction and raises lifetime value through better cross sell and retention.

Second, automation is spreading beyond email and single channel triggers. Large consumer brands are investing in journey orchestration, multichannel decisioning, and experimentation platforms that operate across web and app. The main constraint is not the software. It is the process work required to align marketing with product and customer experience. Teams that connect marketing operations to product analytics and engineering sprints see faster payoffs because experiments can move from idea to rollout in days, not months.

Third, the conversation has shifted for mid market firms and startups. The priority is not owning a long list of tools. It is measurable revenue impact at a sensible monthly cost. That is pushing adoption of bundled suites and composable stacks with carefully chosen integrations rather than maximal stacks that try to do everything. In practice this can look like a modern CRM linked to a performance data warehouse, an experimentation layer, and a retail media optimizer, rather than a dozen point solutions that duplicate features. It is also changing how vendors pitch. Price transparency, time to value, and native connectors matter more than slideware.

Sector examples help ground the trends. In fast moving consumer goods, the top spenders on digital are also the brands building more sophisticated stacks. Journey design, marketing mix modeling, and creative automation are more mature here because store level and marketplace data can be linked to campaign inputs at scale. In travel and hospitality, a cluster of brands is closing the loop between media and booking with lookalike models, real time offers, and lifecycle triggers that move users from browse to purchase inside a single session. In consumer internet, growth teams run multivariate experiments weekly and let product analytics inform media bids and creative within hours. These examples are not isolated. They reflect a shift toward operating models where marketing, product, and data sit side by side.

Financial services show a different path to the same destination. Compliance and consent management are the gating factors, but once those are addressed, the payoff from better data is immediate in underwriting, cross sell, and fraud control. BFSI brands that built early capabilities in analytics are now adding decisioning and content personalisation that speak to lifecycle moments rather than campaign calendars. The net effect is that the same tools that reduce risk can raise marketing return on investment, a combination that protects technology budgets even when total marketing outlays are flat.

If the direction of travel is clear, three friction points explain why adoption still trails mature markets on average. The first is underuse of purchased tools. The statistic that only a little over half of purchased tools are in active use is a reminder that procurement without implementation discipline is a tax on the P and L. The second is integration difficulty. A modern stack is composable by design, but stitching identity, consent, data, orchestration, and measurement into a smooth flow is hard without strong internal partnerships. The third is talent. India has deep engineering and data science pools, yet many organizations still lack embedded marketing operations and experimentation talent that turn license costs into repeatable wins.

What should decision makers do with this picture. The first priority is to tie budgets to measurable outcomes. When marketing budgets as a share of revenue hold steady, the brands that win are those that can show how a rupee invested in data and automation lowers acquisition cost or raises conversion by a clear margin. The second is to consolidate stacks with discipline. Buying fewer tools and using them fully often beats a sprawling set of point solutions that fragment data and attention. The third is to treat retail media and direct response not as isolated channels, but as parts of a system that includes creative testing, product analytics, and merchandising. Where possible, creative, bidding, and product detail page optimisation should run on a common data service so that experiments and learnings travel across teams.

Policy will also shape stack choices. Data protection frameworks and platform changes influence both media efficiency and software design. Privacy preserving measurement, consented first party data capture, and server side tagging have become table stakes. Indian brands that invested early in clean rooms and data collaboration now have an advantage as measurement models change. The same is true for brands that rebuilt analytics pipelines for a mobile first internet where most discovery, consideration, and transactions occur on the phone.

Looking to FY26 and beyond, baseline forecasts point to steady growth in the digital share of advertising and a continued push toward technology inside marketing. Industry outlooks suggest mid to high teens compound annual growth for digital ad spends through the rest of the decade. That path implies continued expansion of the market and more headroom for performance driven categories. The combination of macro growth, channel shift, and a compounding retail media engine sets the stage for larger and more sophisticated software investment by Indian brands.

The benchmark to measure progress will not be licenses purchased. It will be value realised. A practical test is to connect technology allocations to three hard outcomes. The first is speed. Do teams ship campaigns, experiments, and product led growth motions faster than last year. The second is efficiency. Do paid media cost per acquisition and cost per incremental sale improve as data and orchestration mature. The third is quality. Do creative and experiences get more relevant for the same or lower cost, which shows up in engagement, conversion, and customer satisfaction. These are not soft metrics. They can be instrumented across the funnel with clear owners and clear reporting cadences.

There are already teams in India that operate this way. In travel, cross functional pods that include marketing operations, product analytics, and data engineering are becoming normal. In large consumer goods companies, pressure to tie campaigns to retail lift is reshaping how marketing and sales use data together. In marketplace advertising, the feedback loop between merchandising and ad placement is tighter every quarter, which creates demand for decisioning tools that operate closer to the edge and react within minutes. None of these shifts require a specific tool by name. They require stack choices that make collaboration easier and measurement more credible.

The next step for the industry is better public data. A MarTech Spend Index for India that tracks allocation by sector and size, and that correlates spend bands with outcomes, would raise the quality of the conversation. The pieces already exist. We have clear digital share trends, global benchmarks on budget shares and tool usage, and directional India views from practitioner led reports. What is missing is a longitudinal, India first index that publishes more than once a year and lets leaders benchmark not just how much they spend, but what they get for it. That index can be built with a short survey and a commitment to publish the same set of charts on a fixed cadence. If the market agrees on those charts, vendor claims will become easier to test and brand strategies will become easier to defend.

For now, the signal is strong enough to act. Digital’s share is higher. Retail media is scaling. MarTech allocations are rising from a low base. The challenge is to ensure that every rupee committed to software shows up in the profit and loss through lower acquisition cost, higher conversion, and faster growth. The opportunity is to use India’s mobile first internet and data rich marketplaces as the proving ground for stacks that are simpler, faster, and more accountable. The brands that treat MarTech as the backbone of marketing, and not as a shelf of tools, will write the next chapter of India’s growth story.